cap and trade vs carbon tax canada

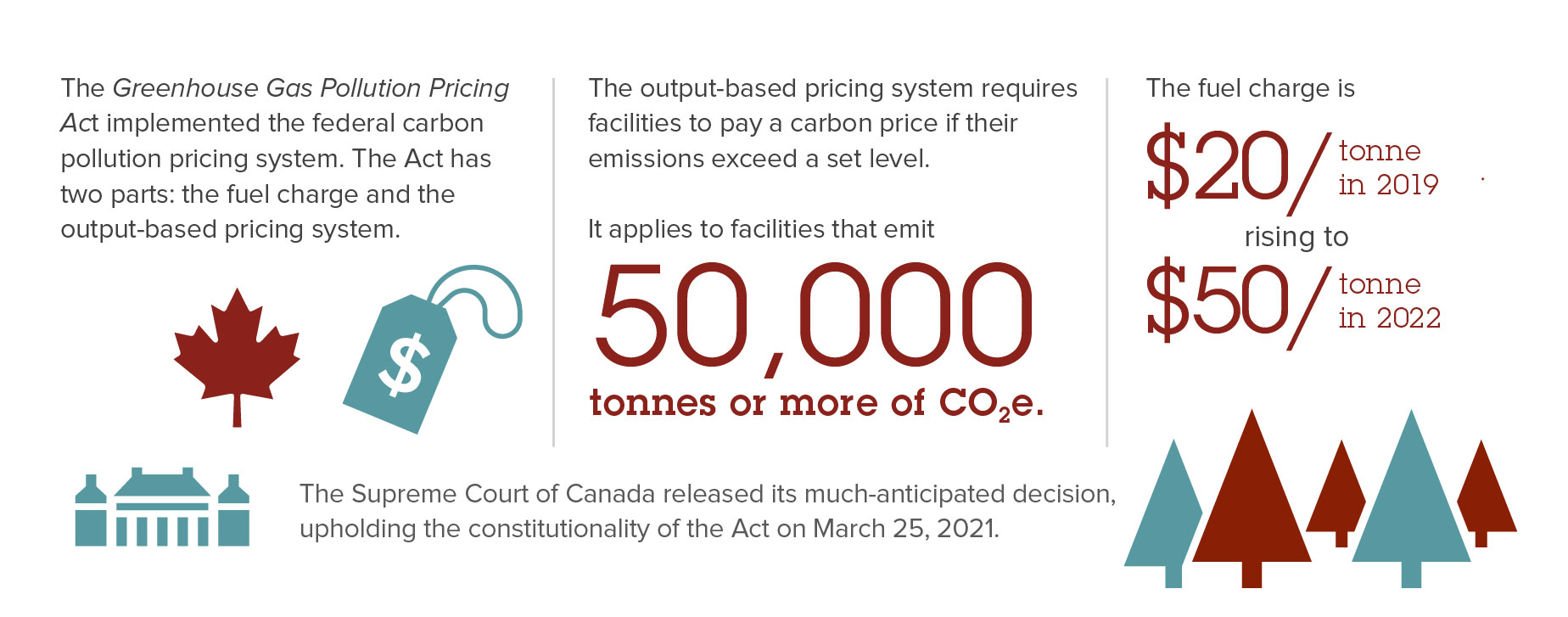

As part of the national carbon plan starting in 2018 the Canadian government will set a 10tonne tax for any province that does not put their own carbon pricing plan in place. A carbon tax is one way to put a price on emissions.

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca

A Carbon Tax vs Cap-and-Trade.

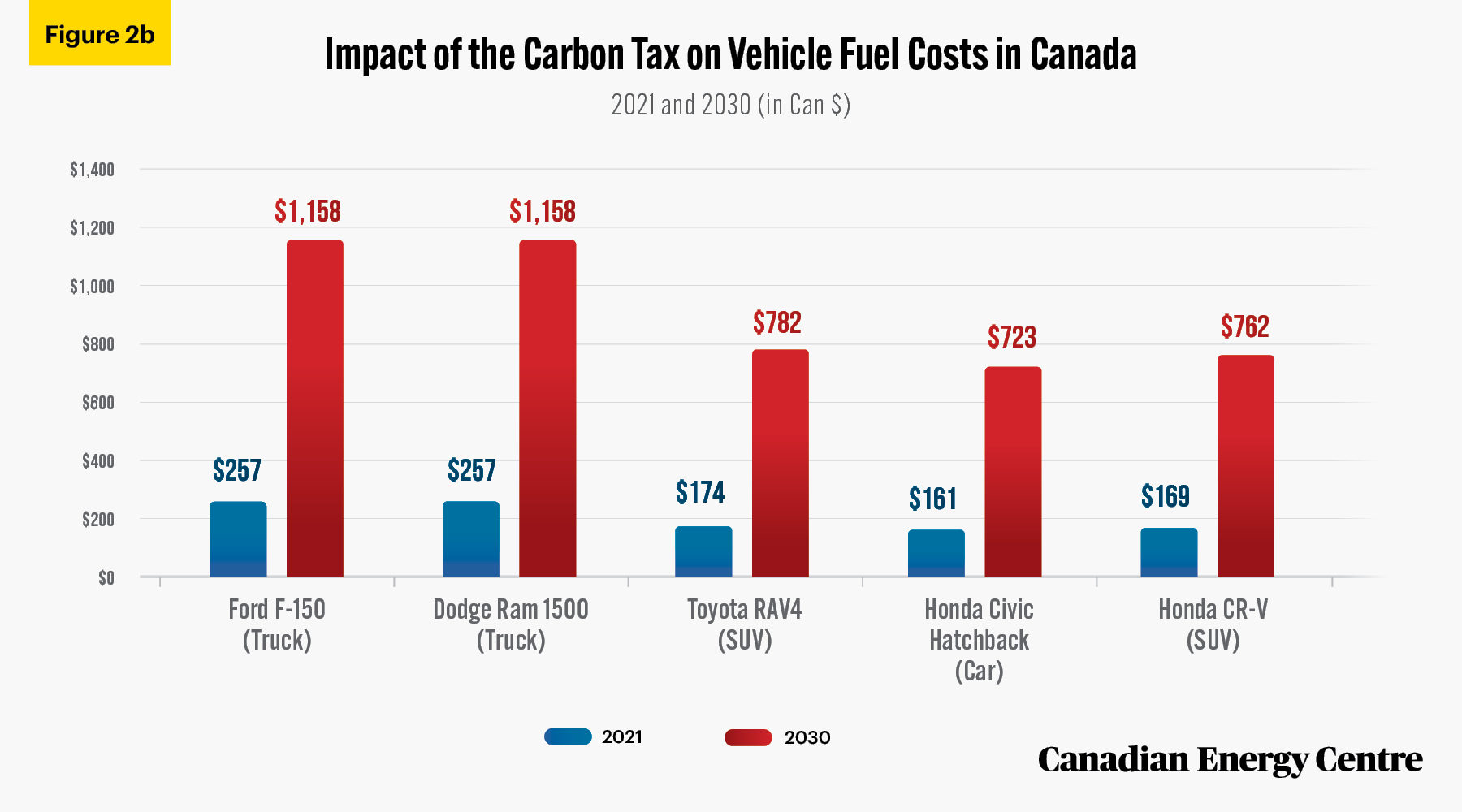

. This tax will then increase by 10tonne every year until it reaches 50tonne in 2022. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so. You can do the same to cap-and-trade.

A carbon tax and cap-and-trade are opposite sides of the same coin. With a carbon tax there is. The paper is written by the Chambers Senior Economist Tina Kremmidas.

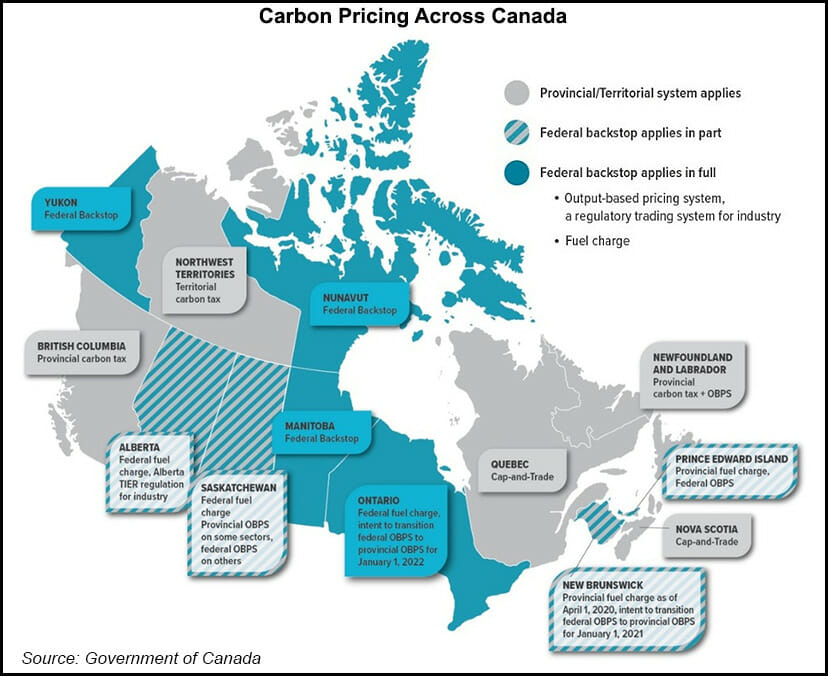

Canada for example has announced a national price to take effect in 2018 while Mexico has announced a 12-month cap-and-trade pilot that will. And it seems likely. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at.

However in reality they differ in many ways. With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms. Thats the greenest building in New York exclaimed Vincent DeVito last month pointing skyward from a busy corner in midtown Manhattan.

No Clear Winner as Ontario Joins California. Cap and Trade vs. Indeed in stable world with perfect information cap and trade would be exactly equivalent to a.

You can tweak a tax to shift the balance. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences. A carbon tax is a legal binding associated with harmful emissions charge Macleans 2016.

Quebecs cap and trade system provides 100 relief to process emissions. Prime Minister Justin Trudeau announced a new nation-wide 10 per tonne carbon tax that will start in 2018 -- a price that will rise by 10 per year topping out at 50 by 2022. Carbon Tax vs.

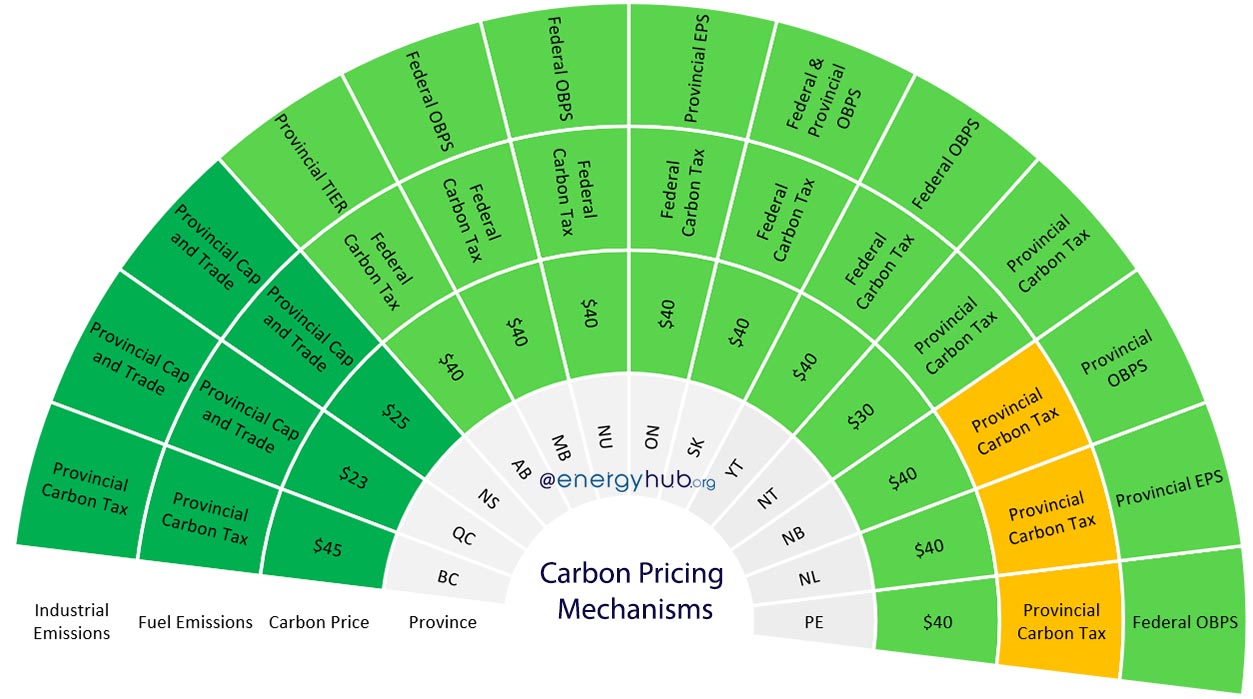

In Quebec and Nova Scotia the governments cap the amount of emissions theyll allow each year then hold quarterly auctions so companies can buy emissions credits within that amount. With a tax you get certainty about prices but uncertainty about emission reductions. With a cap you get the inverse.

A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a cap-and-trade program issues a set number of emissions allowances each year. Californias cap and trade system provides additional relief to sectors at high risk of carbon leakage and with more than 50 process emissions. A carbon tax sets the price of carbon dioxide.

The tax is applied for every tonne of GHGs consumed. It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. In a carbon tax scenario emitters must pay for every ton of GHG they emit - thereby creating an incentive to reduce emissions in the house as much as possible to avoid the tax burden.

Several provinces have already introduced a carbon tax including British Columbia Alberta and Quebec. Starting in 2021 process emissions will be subject to a tightening rate of 05 per year. Each approach has its vocal supporters.

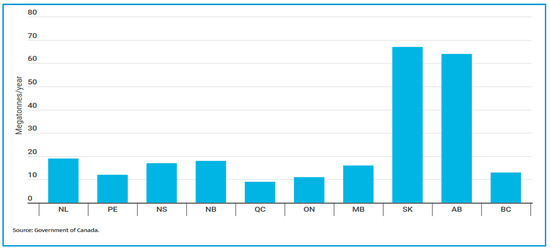

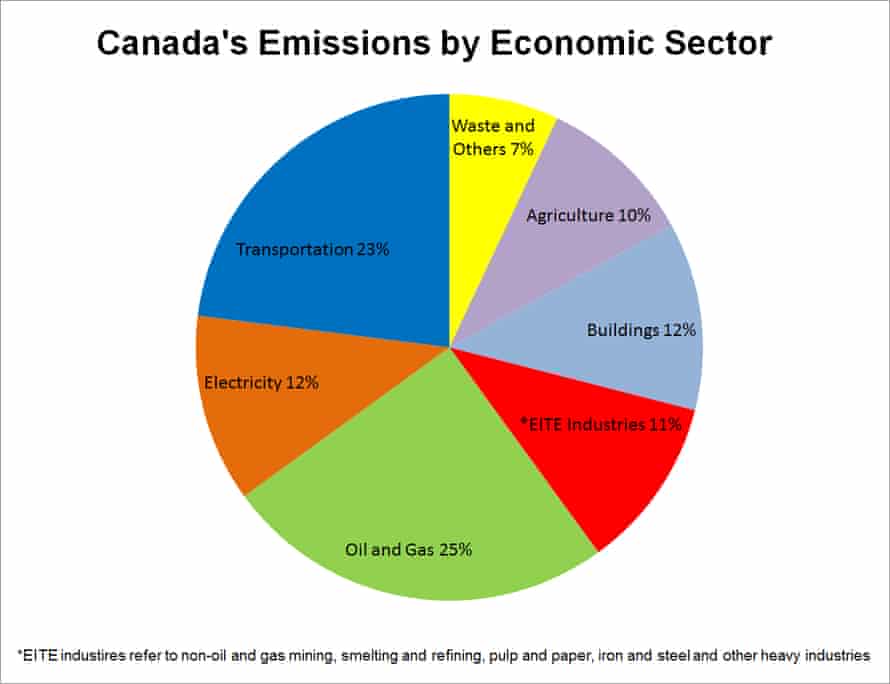

Cap and trade differs from a tax in that it provides a high level of certainty about future emissions but not about the price of those emissions carbon taxes do the inverse. Another implication with the imposition of a carbon tax or cap and trade system is that depending on the industry specialization of the country it can result in primarily hurting the industries that are key actors in the local economy. By Taras Berezowsky on April 15 2015.

The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the buildup of greenhouse gas emissions. While the federal Liberals tell us that its essential to have a carbon tax that will rise to 170 a tonne by 2030 Quebecs cap-and-trade plan. Both can be weakened with loopholes and favors for special interests.

For instance the Conservative government in Canada had opposed carbon pricing arguing that it would. Cap and Trade vs. While British Columbia and Alberta have a carbon tax Quebec uses a cap-and-trade system instead.

Carbon pricing is flourishing in North America. Cap and trade. Political reality being what it is either is likely to impose a fairly low.

Carbon taxes vs. In certain idealized circumstances carbon taxes and cap-and-trade have exactly the same outcomes since they are both ways to price carbon. The cap and trade system is thus functionally similar to a tax on carbon.

The following are the authors final thoughts on the. Cap-and-Trade vs Carbon Tax. Carbon Tax Matthew Hennessey December 19 2007 This article was originally published by Carnegie Councils online magazine Policy Innovations.

Canada a heavyweight in population and GDP for our Neighbors to the North. Theory and practice Robert N. With a cap and trade scenario emitters have the flexibility to reduce emissions in the house or purchase allowances from other emitters who have achieved surplus reductions of their own.

A cap may be the preferable policy when a jurisdiction has a specified emissions target. British Columbia for instance has its own higher carbon tax in place which rose to 30 per ton this year and Quebec has enacted a local. April 9 2007 413 pm ET.

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions.

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

Canadian Carbon Prices Rebates Updated 2021

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Breakthrough Strategic Transportation Solution Provider

The Carbon Tax For Dummies Why Do We Need It And What Will We Pay Greenhouse Gases Energy Conservation Greenhouse Gas Emissions

Climate Change Not Looking So Hopeless A Map Of Climate Change Policies Around The World Link To Pdf Of Source Report In Comments Climate Change Policy Climate Change Climate Policy

Carbon Tax Pros And Cons Economics Help

Your Cheat Sheet To Carbon Pricing In Canada Delphi Group

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

Up To 350 Per Cent Higher At The Pump By 2030 The Impact Of Higher Carbon Taxes On Gasoline Prices Canadian Energy Centre

Breakthrough Strategic Transportation Solution Provider

Federal Government S Carbon And Greenhouse Gas Legislation Canada

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca

Sustainability Free Full Text Carbon Taxation A Tale Of Three Countries Html

Where Carbon Is Taxed Overview

Pin By Yvonne Williams On Canada Oh Canada Cap And Trade Gas Prices The Province

Dear Corporate Canada It S Time To Pay For Your Part In Climate Change Guardian Sustainable Business The Guardian